Emergence of ADCs as the “hot, new technology”

The recent acquisition of ImmunoGen by AbbVie, which followed the earlier acquisition of Seagen by Pfizer, has brought renewed attention to antibody-drug conjugates (ADCs), highlighting their potential in cancer therapy1, 2.

This development serves as an opportunity for companies to reflect on the progress within the ADC field and consider its implications for the future of cell therapies. In this article, I provide a brief overview of the history of ADCs, exploring their evolution and what they can teach us about advancing cancer treatments. The aim is to offer insights into the challenges and opportunities that lie ahead for ADCs and cell therapies, shedding light on lessons that may shape the cell therapy space.

Brief overview of ADCs

The concept of ADCs emerged not long after the initial development of monoclonal antibodies (mAbs). At the time, mAbs had been heralded as the “magic bullet” to treat a range of diseases, including cancer, infections, and inflammatory diseases3, 4.

When it became apparent that “naked” mAbs were not as effective as originally anticipated, people began looking at ways to enhance their activity by using the mAb as a targeting agent, rather than as an active agent in itself. Two different approaches were the focus of attention in the 1990s and 2000s – attaching either cytotoxic drugs or isotopes to the antibody backbone (to create ADCs or radio-immunotherapeutics, respectively) as a means of delivering a toxic payload to cells targeted by the mAb. Each approach had its pros and cons and, ultimately, both yielded approved drugs (with ADCs proving to be the more successful)5, 6.

The first approved ADC was Mylotarg (gemtuzumab ozogamicin), an anti-CD33 mAb linked to calicheamicin for the treatment of AML. It was developed originally by Celltech (acquired by UCB in 2004) and Wyeth (acquired by Pfizer in 2009), approved by the FDA in 2000 (under a subpart H accelerated approval), and marketed by Wyeth7. Its confirmatory Phase III clinical trial failed. This, plus a very poor safety profile and low sales, encouraged Pfizer to withdraw Mylotarg from the market in 2010 at the request of the FDA [8]. At the time, annual sales of the drug were just $20 million9. In 2017, Pfizer applied for re-approval of Mylotarg based on a new Phase III trial in older patients and it was approved anew by the FDA in the same year8.

Driven at least in part by the clinical and commercial disappointments of Mylotarg, ADCs fell out of favour during the 2000s. A small number of companies, notably ImmunoGen (founded in 1981 and listed in 1989) and Seattle Genetics (later renamed Seagen, founded in 1997 and listed in 2000) persevered with the technology, focusing on their own favourite drug molecules and proprietary antibody linkers10, 11.

The 2000s were a challenging period for ADCs, reflected by the fact that it wasn’t until 2011 that the second ADC product was approved by the FDA – Seattle Genetics’ Adcetris (brentuximab vedotin), an anti-CD30 ADC for the treatment of lymphoma. Seattle Genetics and Immunogen remained the flagship ADC companies through the 2000s, 2010s, and 2020s, with a limited number of other companies venturing into the space12, 13.

During the late 1990s and early 2000s, ImmunoGen was moderately successful in attracting development partners for its technology, including the likes of Genentech and Millennium (the company where I was working at the time). Genentech was trying to develop an ADC version of Herceptin (trastuzumab) and Millennium was developing an ADC for the treatment of prostate cancer based on the anti-PSMA mAb J591 (which I had in-licensed for the company in 2001)14, 15. Both ADCs failed, due to instability of the linker molecule, which allowed the very toxic drug (maytansine) to be released into the circulation and cause severe haematological adverse events. As a result, Immunogen’s partnerships languished and it was forced to make improvements to its platform. It also tweaked its business model to rely less on development partners and focus more on developing its own product pipeline15.

ImmunoGen’s lead development programme was a folate receptor alpha (FRa)-targeted ADC, which ultimately became Elahere (mirvetuximab soravtansine). Elahere suffered multiple development setbacks, including a failed Phase III study, but was ultimately granted accelerated approved by the FDA in ovarian cancer in late 2022. This success led to the acquisition of ImmunoGen by AbbVie for $10 billion in late 20231.

Recent ADC deal activity

Until relatively recently (i.e., the last two to five years), big pharma remained largely equivocal on ADCs. However, by 2021 there were 11 FDA-approved ADC products, with a combined market size projected at $16.5 billion by 203016.As a result, pharma companies with oncology franchises could no longer ignore ADCs, ultimately leading to an explosion of deal-making17.

Lessons for cell therapies

The history of ADCs is typical of the development of a new therapeutic modality. It’s similar to what occurred with recombinant proteins, mAbs, gene therapies, etc.; namely:

- Initial investment is driven by the hype and enthusiasm of an exciting new field.

- Innovator companies lead the charge, only to find that multiple problems need to be solved to move the technology forward, resulting in slower-than-expected progress.

- Early results don’t meet unrealistic expectations; investors and partners move on to the next “shiny” thing; the “true believers” persevere through the tough times to sort out the problems; and regulators work out how products need to be characterised and controlled.

- Eventually, the problems are solved, products get approved, and the sector becomes hot again.

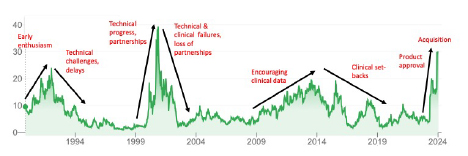

The ImmunoGen share price chart (below) is an excellent reflection of the cycle of ups and downs (NB: annotations are my interpretation of the drivers behind share price movements according to developments and setbacks in the technology).

The cycle from hot to cold to hot again can take 10-15 years and a new technology may go through more than one such cycle (as is evident in the chart above). ADCs are the current “hot thing” in pharmaceuticals, but that was definitely not the case (for ImmunoGen at least) in 1994-1999, 2004-2009, and 2016-2021.

While cell therapies represent a product class much more complex than ADCs (with multiple product sub-classes for different cell types, cell sources, clinical applications, etc.), the overall pattern will be no different. In relation to allogeneic cell therapies for the treatment of cancer, we’ve already seen the initial hype and enthusiasm, driving the creation of multiple companies and large inflows of capital from investors and development partners. We’ve seen (and continue to see) the emergence of technical and clinical challenges. As a result, over the past couple of years, we’ve seen investors and pharma partners move on to “the next shiny thing” (like mRNA and, more recently, ADCs)18, 19. We’ve also seen some companies exit the field (e.g., Precision Biosciences)20.

This situation will change.

The change will be driven by the companies (and their supporters) that persevere to solve the problems and generate compelling clinical data. And when this happens (irrespective of which company solves the problems), investor and partner interest will flow back into the sector. Unlike ADCs, where only a handful of companies were advancing the technology for many years, the cell therapy space is intensely competitive. From a straight competitive intensity perspective, this is a negative. However, it also means that there is a lot more capacity and capability in the field for problems to be solved, so that the cycle with cell therapies could be much shorter than that seen with ADCs.

Development of new drug technologies is a long and complex process, for which one (if not the) critical success factor is the ability to survive and persevere through the tough times in order to achieve ultimate success. This is the immediate challenge for companies in the cell therapy space.

References

- Abbvie. AbbVie to Acquire ImmunoGen, including its Flagship Cancer Therapy ELAHERE® (mirvetuximab soravtansine-gynx), Expanding Solid Tumor Portfolio. 2023 13/03/2024]; Available from: https://news.abbvie.com/2023-11-30-AbbVie-to-Acquire-ImmunoGen,-including-its-Flagship-Cancer-Therapy-ELAHERE-R-mirvetuximab-soravtansine-gynx-,-Expanding-Solid-Tumor-Portfolio.

- Pfizer. Pfizer Completes Acquisition of Seagen. 2023 18/03/24]; Available from: https://www.pfizer.com/news/press-release/press-release-detail/pfizer-completes-acquisition-seagen.

- J. K. Liu, The history of monoclonal antibody development - Progress, remaining challenges and future innovations. Ann Med Surg (Lond), 2014. 3(4): p. 113-6.

- C. Peters and S. Brown, Antibody-drug conjugates as novel anti-cancer chemotherapeutics. Biosci Rep, 2015. 35(4).

- E. Jabbour, S. Paul, and H. Kantarjian, The clinical development of antibody-drug conjugates - lessons from leukaemia. Nat Rev Clin Oncol, 2021. 18(7): p. 418-433.

- C. A. Boswell and M. W. Brechbiel, Development of radioimmunotherapeutic and diagnostic antibodies: an inside-out view. Nucl Med Biol, 2007. 34(7): p. 757-78.

- I. Niculescu-Duvaz, Technology evaluation: gemtuzumab ozogamicin, Celltech Group. Curr Opin Mol Ther, 2000. 2(6): p. 691-6.

- C. Selby, L. R. Yacko, and A. E. Glode, Gemtuzumab Ozogamicin: Back Again. (2150-0878 (Print)).

- R. Staines. The curious case of Mylotarg: Pfizer's leukaemia drug set to return. 2017 13/03/2024]; Available from: https://pharmaphorum.com/news/pfizer-mylotarg-looks-set-return.

- Immunogen. Our History. 2024 13/03/2024]; Available from: https://www.immunogen.com/who-we-are/our-history/.

- Seagen. Our history. 2024 13/03/2024]; Available from: https://www.seagen.com/who-we-are/history.

- N. Joubert, et al., Antibody-Drug Conjugates: The Last Decade. Pharmaceuticals (Basel), 2020. 13(9).

- A. Nawrat. Timeline: charting the choppy history of ‘magic bullet’ antibody-drug conjugates. 2021 13/03/2024]; Available from: https://www.pharmaceutical-technology.com/features/antibody-drug-conjugates-timeline/.

- B. Carlson, Antibody-Drug Conjugates: Where the Action Is: ADCs - The New Frontier. (1554-169X (Print)).

- M. O. Niaz, et al., Prostate-specific Membrane Antigen Based Antibody-drug Conjugates for Metastatic Castration-resistance Prostate Cancer. Cureus, 2020. 12(2): p. e7147.

- DataM Intelligence. Antibody Drug Conjugates Market Size, Share, Industry, Forecast and outlook (2024-2031). 2024 18/03/2024]; Available from: https://www.datamintelligence.com/research-report/antibody-drug-conjugates-market.

- A. Liu. JPM24: As cancer players jump head-first into ADC field, Novartis CEO explains how he's resisted the temptation. 2024 13/03/2024]; Available from: https://www.fiercepharma.com/pharma/jpm24-cancer-players-jump-head-first-adc-field-novartis-ceo-explains-how-hes-resisted.

- NHS Imperial College Healthcare. First UK patients receive experimental mRNA therapy for cancer at Imperial College Healthcare. 2024 13/03/2024]; Available from: https://www.imperial.nhs.uk/about-us/news/first-uk-patients-receive-experimental-mrna-cancer-therapy-at-imperial-college-healthcare.

- BioPharma Asia. Astrazeneca advances its progress in immuno-oncology, ADCs, cell therapy and epigenetics at AACR. 2023 13/03/2024]; Available from: https://biopharma-asia.com/sections/astrazeneca-advances-its-progress-in-immuno-oncology-adcs-cell-therapy-and-epigenetics-at-aacr/.

- F. Vinluan. Precision Bio Offloads Lead Cell Therapy Program in Pivot to In Vivo Gene Editing. 2023 13/03/2024]; Available from: https://medcitynews.com/2023/08/cancer-cell-therapy-lymphoma-in-vivo-gene-editing-precision-biosciences-imugene/.